Florida Housing first-time homebuyer programs

The Florida Housing homebuyer programs help Floridians find affordable, quality housing within their budgets. Your loan will not be issued directly by Florida Housing. Instead, you’ll work through a participating lender to secure your home loan.

If you need help covering the upfront costs of buying a home, your lender may help you apply for a second loan to cover your down payment and closing costs.

More: How much house can I afford calculator

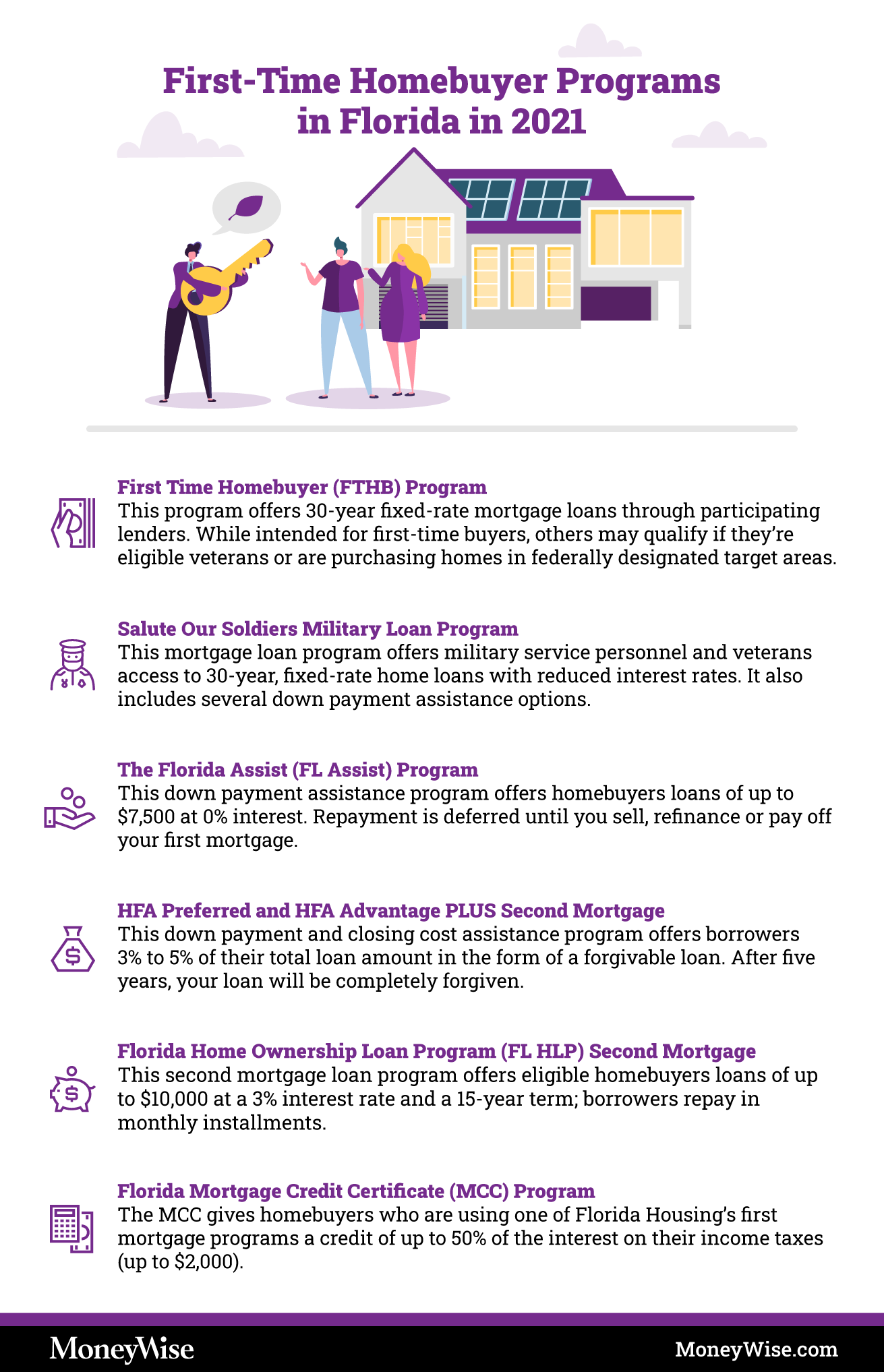

First Time Homebuyer (FTHB) program

This Florida program for first-time homebuyers offers 30-year fixed-rate mortgage loans through participating lenders. While the program is intended for first-time buyers, other buyers may qualify if they’re eligible veterans or are purchasing homes in federally designated targeted areas. Your lender can let you know if you qualify even if you’re not a first-timer.

You’ll also have to meet Florida Housing’s income and purchase price limits, as well as the standard requirements for your loan type. First-time homebuyers are required to complete a Department of Housing and Urban Development-approved homebuyer education program.

Salute Our Soldiers Military Loan program

This mortgage loan program offers military service personnel and veterans access to 30-year, fixed-rate home loans with reduced interest rates. It also includes several down payment assistance options.

To qualify for this program, you’ll need to be purchasing a home that will serve as your primary residence, meet income and purchase price limits, and complete a homebuyer education course.

More: How the mortgage underwriting process works

The Florida Assist (FL Assist) program

This down payment assistance program offers homebuyers loans of up to $7,500 at 0% interest. Repayment is deferred until you sell, refinance or pay off your first mortgage. At that point, you’ll be expected to repay your FL Assist loan in full.

HFA Preferred and HFA Advantage PLUS Second Mortgage

This down payment and closing cost assistance program offers borrowers 3% to 5% of their total loan amount in the form of a forgivable loan. After five years, your loan will be completely forgiven.

Florida Home Ownership Loan Program (FL HLP) Second Mortgage

This second mortgage loan program offers eligible homebuyers loans of up to $10,000 at a 3% interest rate and a 15-year term; borrowers repay in monthly installments. As this is another mortgage loan, your debt-to-income ratio may be considered to ensure you can manage the monthly payments.

Florida Mortgage Credit Certificate Program

A Mortgage Credit Certificate (MCC) is a dollar-for-dollar tax credit for a set percentage of the interest you pay on your mortgage every year. The MCC gives homebuyers who are using one of Florida Housing’s first mortgage programs a credit of up to 50% of the interest on their income taxes (up to $2,000). To be eligible for the MCC, you’ll have to be a first-time homebuyer and meet Florida Housing’s income and purchase price limits.

More: Mortgage rate trends this week

Stop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

SmartFinancial can help you do just that. SmartFinancial’s online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better ratesWho qualifies for the first-time homebuyer programs in Florida?

Florida Housing’s homebuyer programs are designed to help low- to moderate-income households secure affordable, quality housing. To qualify for assistance, you’ll have to fall within Florida Housing’s income and purchase price limits, as well as the standard requirements for your loan type.

More: Get a free credit score and credit monitoring from Credit Sesame.

Nationwide first-time homebuyer programs

When assessing your application for a “conventional” mortgage, lenders in the private market will usually expect to see a credit score of at least 620 and a down payment of at least 5% of the overall purchase price.

If you’re coming up a little short in either respect — as many first-time buyers do — you should look into one of the following nonconventional mortgages, which you can source through the federal government.

More: Build up your down payment. Compare savings accounts

FHA loans

In 1934, the Federal Housing Administration created FHA loans to encourage Americans to buy homes. At the time, about 60% of Americans rented instead of buying.

FHA lenders will grant you a loan with a credit score as low as 580 and a minimum down payment of just 3.5%, making these loans accessible to more Americans. But depending on how much money you put down, you will face long-lasting fees for mortgage insurance. Try putting down 10% if you can; 20% is even better.

More: FHA loan requirements

VA loans

VA loans were created toward the end of World War II to help veterans buy homes of their own. An act passed by Congress in 1944 made it possible for the U.S. Department of Veterans Affairs (VA) to guarantee or insure home, farm and business loans made to veterans by lending institutions.

To qualify for one of these loans, you must be an active service member, veteran or a surviving military spouse. You won’t have any down payment or mortgage insurance obligations, but you will have to pay a sizable funding fee.

More: How VA loans work

USDA loans

USDA loans, which are guaranteed by the United States Department of Agriculture, also don’t require down payments or mortgage insurance. These loans are targeted to lower-income rural and suburban Americans.

Borrowers will find they’re charged an upfront 1% guarantee fee and an annual 0.35% fee. But if you do the math, the sum of those fees tends to be less in the long run than the mortgage insurance associated with other types of loans.

That said, you may make too much money to qualify for a USDA loan. The current income limits in most parts of the U.S. are $86,850 for one- to four-member households and $114,650 for five- to eight-member households, but the thresholds may be higher if you live in a county with a steeper-than-average cost of living.

You can find your region’s limit on the USDA’s website.

Need cash? Tap into your home equity

As home prices have increased, the average homeowner is sitting on a record amount of home equity. Savvy homeowners are tapping into their equity to consolidate debt, pay for home improvements, or tackle unexpected expenses. Rocket Mortgage, the nation's largest mortgage lender, offers competitive rates and expert guidance.

Get StartedNext steps

Now that you know all your options for buying a home in Florida, you may be asking yourself: “What next?”

A great first move would be to take a look at your credit score and see how you measure up to your ideal loan’s requirements. You can get a free score through Credit Sesame.

Was your score disappointing? That’s OK — you have plenty of options. A company like Credit Strong can help you give your score a boost - without needing to use a credit card.

Once you’re in good shape, don’t forget to gather the important documents you’ll need to prove you’ve got money in the bank and money floating in.

Then you can finally think about getting pre-approved for a mortgage and start shopping for your new digs.

| Arizona | |

| Arkansas | |

| California | |

| Colorado | |

| Connecticut | |

| Delaware | |

| Florida | |

| Georgia | |

| Hawaii | |

| Idaho | |

| Illinois | |

| Indiana | |

| Iowa | |

| Kansas | |

| Kentucky | |

| Louisiana | |

| Massachusetts | |

| Michigan | |

| Minnesota | |

| Missouri | |

| Montana | |

| Nebraska | |

| Nevada | |

| New Mexico | |

| New York | |

| North Carolina | |

| Ohio | |

| Oklahoma | |

| Oregon | |

| Pennsylvania | |

| South Dakota | |

| Tennessee | |

| Texas | |

| Utah | |

| Virginia | |

| Washington | |

| Wisconsin | |

| Wyoming |

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.