The best states to retire in 2024 – Ranked

EpicStockMedia / Shutterstock

Updated: February 13, 2024

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

So your golden years are approaching, and you want to relocate. Chances are, your existing state isn't the best, and retiring there could be wasting your hard-earned cash. Otherwise, choosing the wrong destination could be even more damaging. Beyond missing out on an enhanced climate, healthcare, amenities, and more, the wrong choice could seriously damage your finances and lifestyle.

We've mathematically calculated the best (and worst) retirement states, using key decision factors like affordability, climate, healthcare access, safety, housing costs, and popularity with retirees. The resulting overall scores identified the most favorable havens.

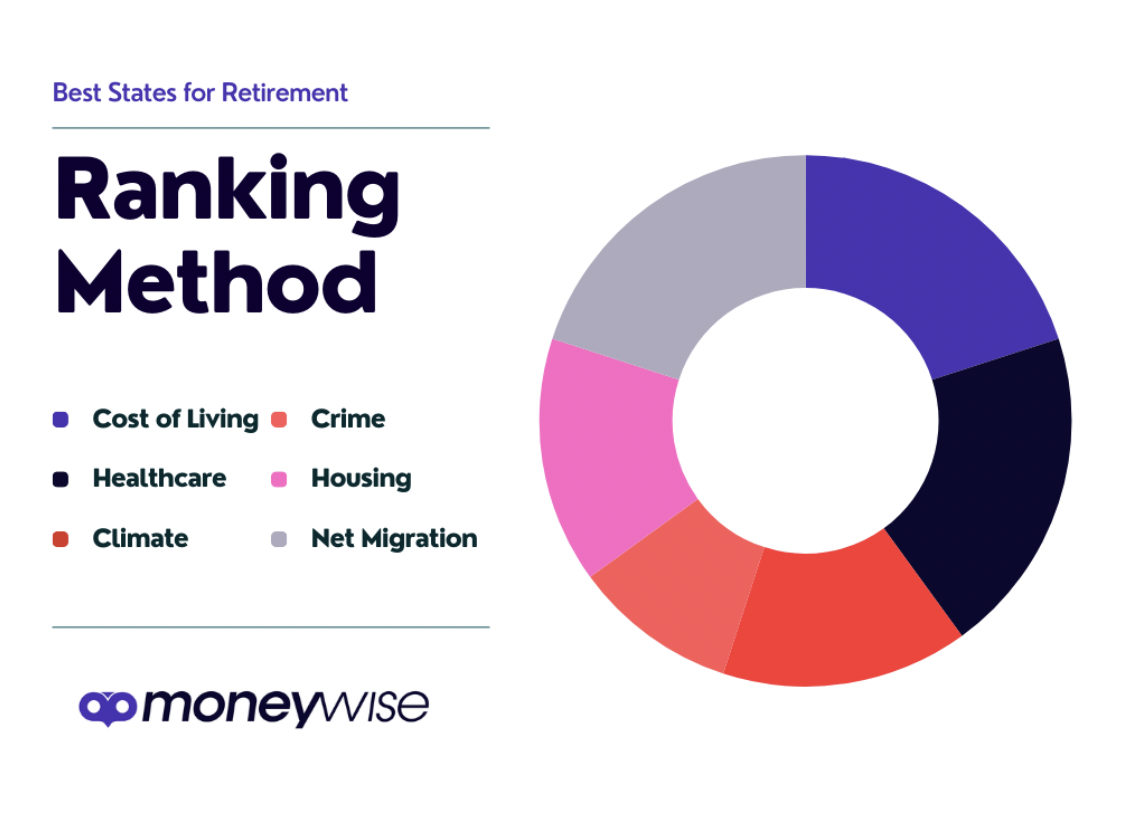

How we ranked the best states for retirement

Our analysis focused on six key categories that are important considerations when choosing a retirement destination: cost of living, healthcare, climate, crime, and housing affordability. We also included net migration (over 65) as a further measure to track retiree flows. The free market is essential because it paints a broader picture of where people are going. The bottom methodology section reveals our mathematical process in detail.

Learn how you can retire wealthier with WiserAdvisorBest states to retire in

1. South Carolina

With its warm climate, low cost of living, and influx of retirees, South Carolina is the best state to retire in. Based on core retiree expenses of groceries and transportation, we calculate that South Carolina is 4.7% cheaper than the national average. This ranks the state as the 10th most affordable for retirees.

Healthcare is inexpensive, scoring as the 8th most affordable state. While not best in class for healthcare quality and access, it still fairs reasonably well, ranking 36th best. This means you'll likely need to visit another state for specialized treatments.

With mild weather and ample sunshine, South Carolina's climate is ideal for enjoying the outdoors year-round in retirement. It sees average temperatures of 62.4 degrees with 50 inches of annual rainfall. While not the absolute warmest or driest state, the climate ranks strongly for comfort.

Housing in South Carolina is roughly 20% more affordable than the nationwide average. At 10th rank, it's a great spot to purchase land or renovate a retirement-friendly home.

Lastly, South Carolina is a top-five destination for retirement immigration. According to a census report, the state sees an annual 6.5% domestic migration rate among the 65-plus population. It's a trendy destination thanks to its affordability, pleasant weather, and access to leisure.

Where to retire in South Carolina

Charleston

Charleston is regularly ranked as one of the top retirement destinations in the country. It offers small-town charm and Southern hospitality, ample cultural activities, dining options, and access to beaches and waterways. The historic downtown area features lovely antebellum architecture and attractions. The cost of living is still reasonable compared to other coastal cities. With that said, average home prices tend to be higher than the state overall.

Greenville

Located in the Upstate region, Greenville has emerged as a popular retirement spot with a quaint, livable downtown full of shops and restaurants. It features a mild climate, a foothills landscape, and convenient access to the Blue Ridge Mountains. Home prices are close to national averages while still enjoying South Carolina's low tax burden.

Bluffton

For retirees seeking a smaller coastal town near Hilton Head Island, Bluffton offers lush natural beauty with walking/biking trails along the May River. The historic district includes antebellum homes and churches. Bluffton is also known for active adult retirement communities. Home prices are often lower than other coastal towns while providing reasonable proximity to attractions.

2. Florida

Florida is a popular retirement destination, with nearly 13% net retiree migration. Sunny weather, reduced violent crime, and an influx of retirees make Florida a top choice to spend the golden years. Beyond that, over 21% of its population already exceeds 65, offering an established community to grow old, comfortably.

Florida's climate leads the pack when considering retirement destinations, with average temperatures of 70.7 degrees, to enjoy pleasant outdoor living, year-round.

Living costs in Florida fall close to the national baseline, scoring 98.7 on our calculated retiree cost of living index. Expenses like groceries and transportation mirror average prices, while healthcare quality ranks mid-tier, at 27th best nationwide.

Housing affordability presents a clear drawback in Florida for retirees. Home prices are 7% higher than typical, ranking Florida 33rd for affordability. For renters and buyers alike, locating reasonably priced residences can prove challenging in popular coastal retirement areas.

Overall, Florida's warm weather, lively retirement communities, and accessibility to quality healthcare offer appeal. However, housing affordability issues pose trade-offs to consider against more budget-friendly states for retirees needing to watch expenses closely.

Where to retire in Florida

Sarasota

Situated on Florida's Gulf Coast, Sarasota offers warm weather, gorgeous beaches, luxury resorts, golf courses, museums, and performing arts. The downtown features boutique shops and dining. Sarasota Memorial Hospital provides quality healthcare. The area is trendy among retirees.

Fort Myers

For an affordable coastal location, Fort Myers boasts old Florida charm mixed with sailing, fishing, and shelling opportunities at Sanibel and Captiva Islands. The cost of living comes in below the national average.

St. Augustine

The nation's oldest city is a great place to grow old. St. Augustine has a history and architecture dating back to the late 1500s. There's abundant sightseeing with quaint bed and breakfast accommodations. The region features several hospitals, healthcare centers, and a pleasant year-round climate.

3. Alabama

With strong affordability and reasonably warm weather, Alabama grabs the title of third-best retirement spot. Home to nearly 18% retirees already, Alabama offers established senior communities. It also has a healthy retiree migration rate of 1.9%, ranking it among the most popular destinations.

Retirees appreciate Alabama's budget-friendly qualities, ranking in the top five for grocery and transportation affordability. Healthcare is also inexpensive, at 14% below the national average, though healthcare quality and accessibility aren't stellar, ranking 44th.

The climate sees average temperatures of 62.8 degrees, with 58 inches of annual rainfall. Mild weather prevails throughout the year for enjoying Alabama's outdoor offerings.

Housing is highly affordable in Alabama, ranking 3rd across the U.S., with prices 30% below average. However, the state has high utility costs, offsetting savings. Renting or buying proves feasible on a limited income for the savings seekers.

Those prioritizing low costs in retirement will find Alabama delivers on value, from healthcare to housing. The weather also cooperates for reasonably comfortable extended seasons without extremes. Seeing community amongst nearly one-fifth of existing retirees further elevates Alabama's appeal.

Where to retire in Alabama

Huntsville

Situated along the Gulf Coast, Gulf Shores offers small beach town vibes with quality golf courses, shopping centers, and seafood restaurants. In 2022, the city introduced a plan to revitalize the public beach. The climate is temperate year-round. Housing consists of condos, apartments, and single-family homes.

Gulf Shores

Situated along the Gulf Coast, Gulf Shores offers small beach town vibes with quality golf courses, shopping centers, and seafood restaurants. In 2022, the city introduced a plan to revitalize the public beach. The climate is temperate year-round. Housing consists of condos, apartments, and single-family homes.

Florence

Overlooking the Tennessee River, Florence provides a rich history. It features historic architecture and outdoor recreation, along with many golf courses. Meanwhile, the downtown area includes many restaurants.

4. North Carolina

North Carolina takes the fourth best spot for retirement based on its moderate costs, mild climate, and growing retirement-age population. Over 17% of the state’s population are seniors, thanks to an annual influx of 5.5% in recent years.

Retirement expenses prove budget-friendly, scoring 4% below the national baseline. Specific costs like groceries, transportation, and healthcare fall lower than standard rates. This affordability powers North Carolina's retirement appeal.

The weather also compares positively, averaging 59 degrees. It’s perfect for enjoying golf, lakes, and coastal towns during extended shoulder seasons. North Carolina avoids more extreme winter and summer conditions for comfort.

Housing affordability is another benefit, roughly 8% lower than the nationwide average. However, safety benchmarks moderately, ranking 32nd for violent crime.

From mountain towns to beaches, access to nature promotes an active lifestyle. The weather cooperates more than in colder northern states for an affordable base to enjoy outdoor recreation amid fellow retirees. North Carolina avoids risky hurricane zones that are more profound in the southeast.

Where to retire in North Carolina

Asheville

Nestled in the Blue Ridge Mountains, Asheville is revered for its natural beauty and outdoor recreation. The lively downtown features Biltmore Village with shopping, dining, and arts.

Wilmington

Wilmington provides seaside living with charm. The relaxed coastal lifestyle includes an award-winning riverfront and historic neighborhoods. It's home to beaches, golf courses, fishing, and botanical gardens. Housing remains relatively affordable.

Winston-Salem

Known as an arts hub, downtown Winston-Salem blends a historic charm with modern innovation. There is a rich culture mixed with wineries and shopping plazas. Plus, the proximity to the scenic foothills and the Yadkin Valley Wine region adds a natural allure, offering a plethora of outdoor adventures.

5. Mississippi

-1707165628.jpg)

Given its ultra-low cost of living and well-rounded attributes, Mississippi emerges as the fifth-best state for retirement. The state already has a solid elderly base, with around 17% of the population older than 65.

Retirees value Mississippi for its budget-friendly qualities, ranking with the cheapest cost of living in America. Pair this with housing costing about 30% less than the state average, and expenses remain minimal. Though, a caveat is surprisingly high utilities costs, at the nation's third most expensive.

The climate also dodges extremes, seeing average temperatures of 63 degrees, though ranking amongst the rainiest states. Seniors can comfortably enjoy outdoor living during most months. Safety compares positively as well, with occurrences of violent crime placing Mississippi among the 12 safest states.

However, Mississippi lacks healthcare accessibility and quality, scoring 49th for this attribute. This means you'll likely have to travel for advanced treatments. Leisure amenities also prove limited, with casinos and country living as primary attractions.

So those able to compromise on location excitements and healthcare access will uncover heavenly savings potential in Mississippi. Its ultra-affordable cost of living is impossible to replicate in more popular Sunbelt destinations and more medical care certificate-friendly areas.

Where to retire in Mississippi

Biloxi

Located along the Gulf Coast, Biloxi provides small-town charm and world-class casinos, golfing, fishing, and beaches. The climate is warm and sunny, turning it into a popular resort destination.

Oxford

As home to the University of Mississippi, Oxford delivers college-town culture, history, and foodie flair. The city has been home to many writers, including William Faulkner. Outdoor recreation prevails at Sardis Lake.

Hattiesburg

Hattiesburg is the state’s fifth largest city by population. It offers a low cost of living with easy access to shopping, dining, and entertainment options. Beyond that, it's a prominent college town.

Learn how you can retire wealthier with WiserAdvisorWorst states to retire in

51. Alaska

Coming in at the very bottom of the Best States to Retire list is Alaska, mainly due to its challenging climate, high cost of living, and increasing number of violent crimes. Its frigid year-round temperatures, sparse population, and distance from critical amenities create significant headwinds.

With average temperatures of 27 degrees and cost of living over 20% more expensive than the national baseline, Alaska proves brutally inhospitable and costly. Furthermore, at nearly 50% pricier, healthcare particularly strains limited retirement budgets and access.

Safety risks also run far higher than average in Alaska, ranking amongst the worst states for violent crime. With such a dispersed population, response times lag while wilderness threats persist. The climate stays unrelentingly harsh outside brief summers, ranking Alaska as the worst for temperature.

In positive balance, Alaska offers a pristine nature. But infrastructure needs more senior services, from assisted living to airports and highways. Most retirees desire connectivity over isolation.

The state seems destined to deter all but the hardiest and well-funded retirees for the foreseeable future. The lifestyle compromises and sacrifices required prove overly burdensome. Alaska stays inhospitably cold, dark, dangerous, and expensive.

50. District of Columbia

As the seat of political power, Washington D.C. caters more to working professionals than retirees looking to relax, pushing it to second-worst place to retire in the country. The high costs, crime rates, and lack of senior amenities undermine livability.

With housing prices more than double the national average, D.C. drains bank accounts, rapidly. Healthcare costs are nearly 20% higher than the national average, yet the quality and access rank amongst the worst.

Violent crime is more prominent in D.C. than in any state, including Alaska. Low livability factors leave D.C. amongst the highest senior migration outflows nationwide, at over 7% annually. Retirees vote against the district with their moves, signifying better options exist elsewhere.

In balance, D.C. does offer world-class cultural amenities from museums to restaurants that engaged seniors can enjoy. The weather is also favorable. However, the focused energy catering to political and business priorities leaves D.C. impractical for retirees. For the average pensioner, the district disappoints.

49. New York

Home to Buffalo, Syracuse, and New York City, New York State has lots to offer. Retirement, however, is outside its agenda. The steep costs, crime rate, and climate make it an impractical choice for most pensioners. Given these factors, the state ranks worst for retiree outflows, at over 7% annually.

Housing prices soar 77% above average, while temperatures average 38 degrees. Across its cities, New York State drains bank accounts rapidly while keeping retirees indoors.

The state’s urban areas deter those desiring relaxation, as crowds, noise, and risks prevail. Outside its cities, options narrow with decreased transportation, healthcare access, and cultural amenities. Destinations with senior appeal, such as the Hamptons, retain a sky-high cost of living. Overall, you’ll be pressed to find a comfortable retirement.

On the positive side, New York does deliver exceptional healthcare access and quality for complex needs to those able to afford premium care nearby. You’ll also be near globally renowned attractions such as Niagara Falls and the Big Apple.

Yet for the typical retiree prioritizing affordability and comfort, New York is too expensive and extreme to justify as a retirement destination.

48. Vermont

While Vermont's quaint towns and natural beauty hold a certain appeal, the state's steep costs, harsh winters, and lack of affordability make it impractical for most retirees.

With a steep 35% above average housing prices, Vermont can drain retirement nest eggs, quickly. The winter climate further disincentives retirees, averaging 43 degrees. This forces more indoor living, and snow isolates many rural towns during winter.

Vermont sees over 8% of its retirement-age population exit annually, seeking more affordable, temperate locales with more amenities. Its retiree outflows rank 2nd highest nationwide.

On the positive side, Vermont boasts the nation's lowest violent crime rates. Healthcare quality is also favorable, ranking 18th despite a 7% cost increase compared to the rest of the country.

However, with high expenses and bleak winters, Vermont is a questionable retirement choice.

47. Montana

Montana ranks as the fifth worst retirement option, driven by a harsh climate with a high retirement cost of living. Its natural beauty, and low crime can't offset enough detriments for most pensioners.

The climate deals the most significant blow, with average temperatures of 43 degrees. The retirement cost of living exceeds the nationwide average by over 7%, including high transportation costs at 15%. This strains limited retirement income potential.

Amenities stay decidedly lacking outside Bozeman or Missoula, with little excitement beyond outdoor recreation. Violent crime rates are also higher than average, ranking at 35. Meanwhile, housing affordability is ranked 30.

In positive balance, Montana offers pristine nature and privacy for rugged individualists craving escape. Yet, in seeking a comfortable balance, Montana disappoints next to alternatives.

Where does your state rank?

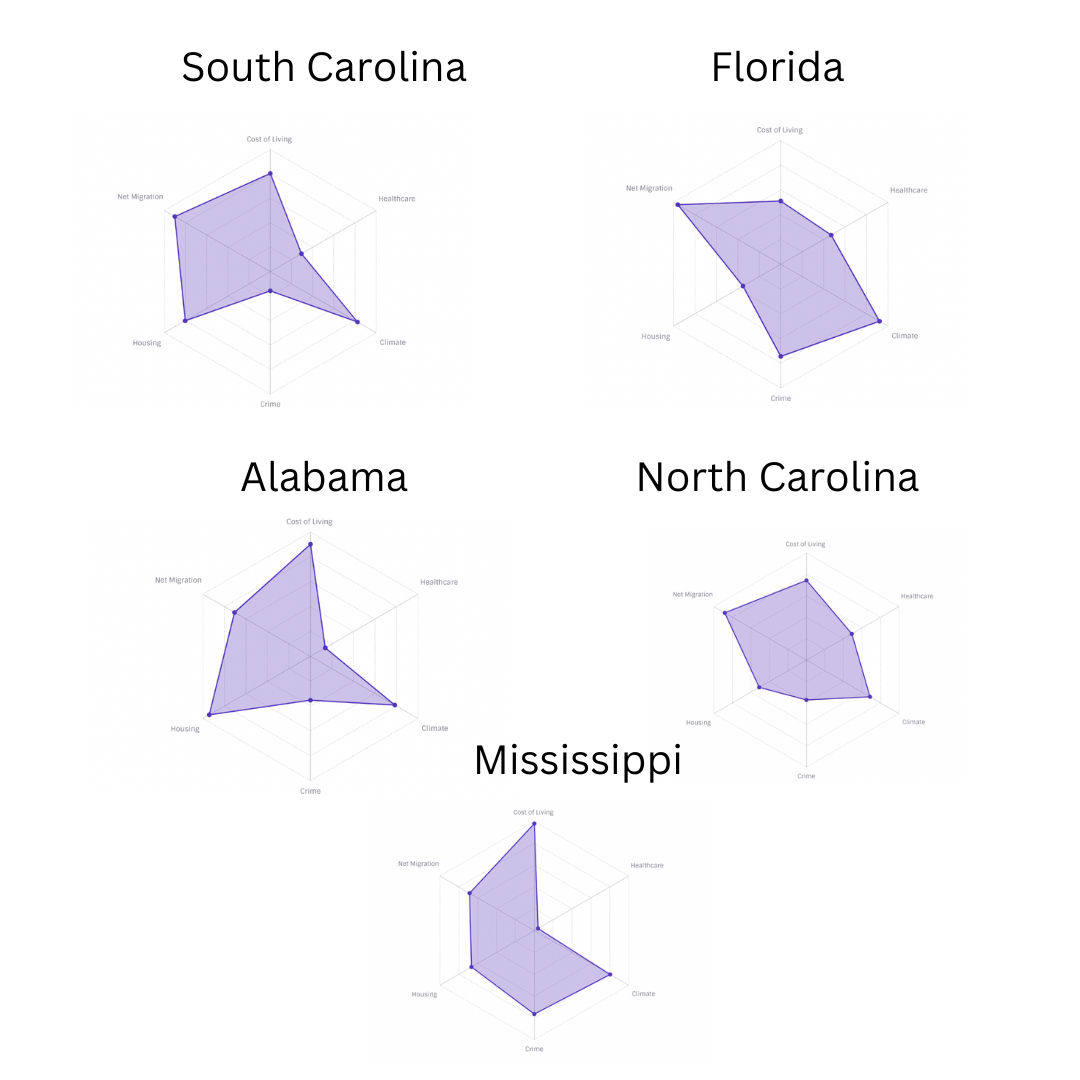

Best states to retire in - a visual

*Note: A factor taking up more space means it’s better

Worst states to retire in - a visual

*Note: A factor taking up more space means it’s better

-1707236345.png)

While our methodology below explains everything in detail, we’ve provided rankings here. Since the first is the best rank, a lower score is better. The table below shows how your state ranks for each factor.

Occasionally, two states have the same score for a specific category. When this happens, we assign a midpoint value between the corresponding points. For example, Nebraska and Wisconsin have identical net migration scores, ranking them across 21 and 22. As such, they’re both assigned a 21.5 rank. This ensures fairness in the final overall ranking.

Factor ranks

7 retirement planning tips

- 1.

Reduce debt, especially high-interest credit cards, through debt consolidation. Entering retirement debt-free is ideal.

- 2.

Learn how much you'll need to save for retirement and create a budget. Use a retirement planning tool to set savings targets and assess shortfalls. Adjust contributions accordingly.

- 3.

Catch up on retirement savings by making significant spending cuts, increasing contributions, or stopping overpaying for home insurance.

- 4.

Assess when to begin claiming Social Security benefits for maximizing lifetime income. Learn if claiming benefits at 62 or 70 is better.

- 5.

Discuss legacy planning to protect assets for heirs. See why this matters in our estate planning guide.

- 6.

Identify hobbies and interests for an active lifestyle in retirement before leaving the workforce. This will keep you with a sense of purpose.

- 7.

Consult a financial advisor for personalized advice on optimizing your finances before and during retirement.

Disclaimer

The content provided on Moneywise is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.